22+ dfvc calculator

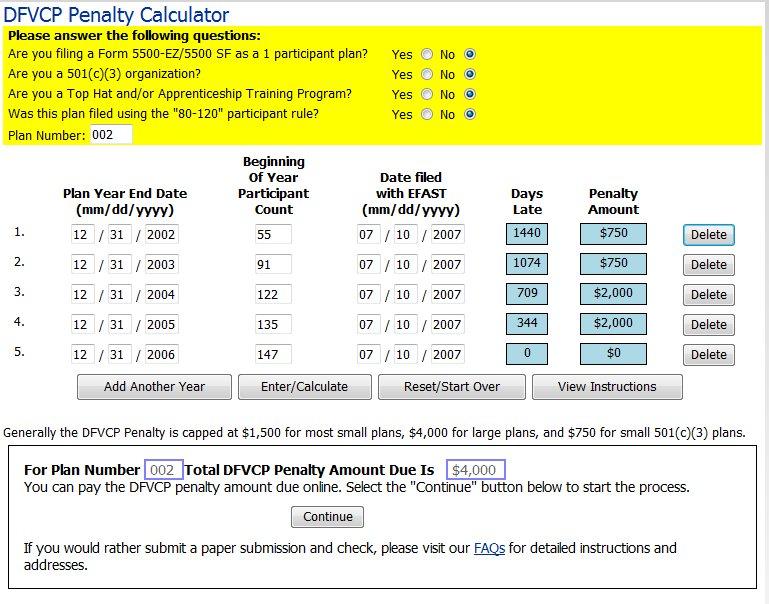

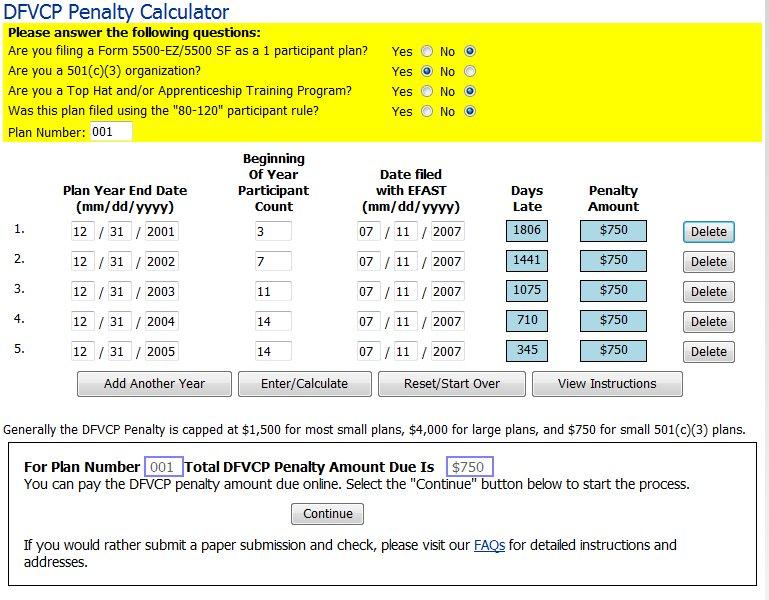

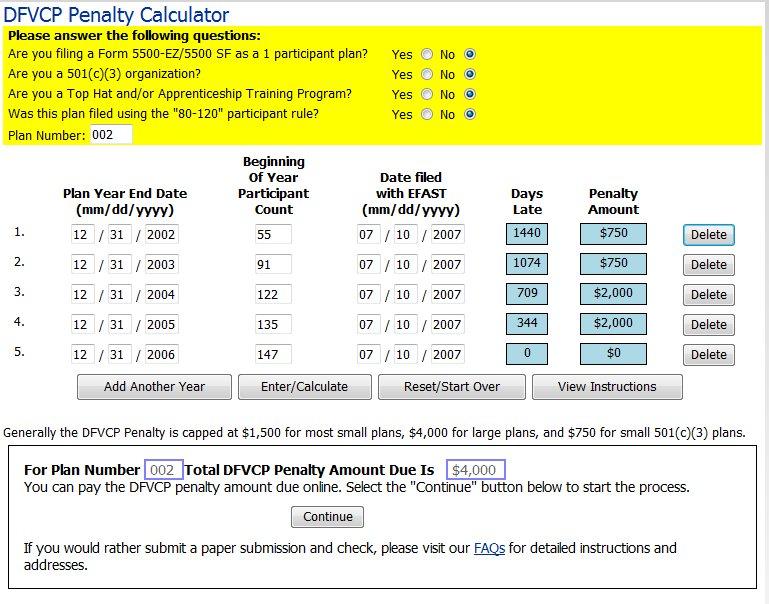

11111111 11111111 11111111 00000000 255 255 255 0. The maximum penalty for a single late annual report is 750 for a small plan and 2000 for a large plan.

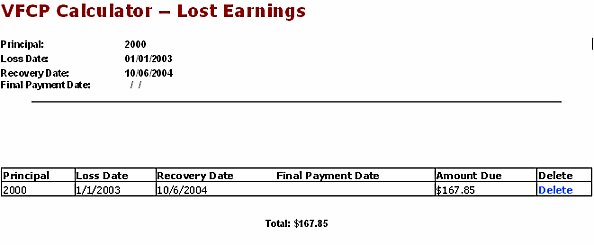

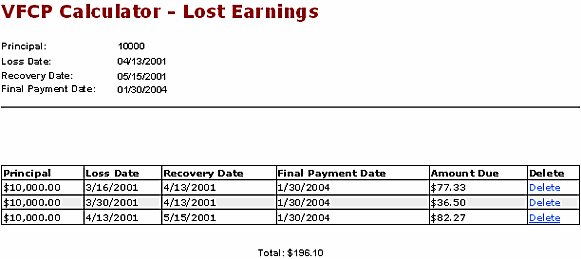

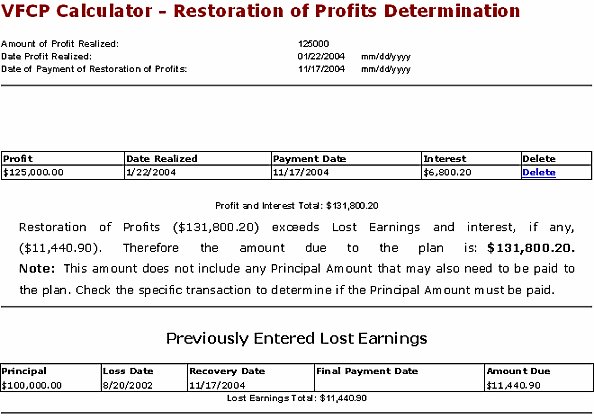

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

The basic penalty under the DFVCP is 10 per day for delinquent filings.

. Forced vital capacity FVC is the total amount of air exhaled during the FEV test. To calculate your disability rating take a look at your VA disability compensation award letter and select your official rating. CIDR is the number of continuous bits of 1s in IP binary notation.

CIDR to network mask. Penalties that otherwise apply. This program allows you to admit that you did not complete the required compliance activities.

We then append the percent sign to designate the. How to Use the VA Disability Pay Calculator. The DFVCP calculator will determine the amount of civil penalties owed by plugging in the type of plan size of plan and number of filings the agency said.

Special simplified rules apply to top hat plans and apprenticeship and. Use this calculator to find percentages. Therefore it is always a good idea to seek the counsel of.

To ensure proper processing the DFVC program box on line D of Part I of the 5500 or 5500-SF must be checked. This program is titled the Delinquent Filer Voluntary Compliance Program or DFVCP. Date Calculator Add or subtract days months years.

FVC Race x 115 x 00443 x Height - 0026 x Age - 289 Where Race variables are. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Percentage difference equals the absolute value of the change in value divided by the average of the 2 numbers all multiplied by 100.

Federal Home Loan Bank advances. The tax calculator provides a full step by step breakdown and analysis of each. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Before sharing sensitive information make sure youre on a federal government site. Weekday Calculator What Day is this Date. 250 per day up to 150000 for each late Form 5500.

Time and Date Duration Calculate duration with both date and time included. The gov means itâs official. Start with a free eFile.

093 for Asian 087. Federal government websites often end in gov or mil. To ensure proper processing the DFVC program box on line D of Part I of the 5500 or 5500-SF must be checked.

This calculator is for 2022 Tax Returns due in 2023. Without the program a plan sponsor faces many potential late filing penalties including. This calculator so you can avoid any errors that could delay your participation in the program.

S3 Supplements Haematologica

Delinquent Filer Voluntary Compliance Program Dfvcp Penalty Calculator And Online Payment With Instructions Examples And Manual Calculations U S Department Of Labor

11 Eagle Loan Springfield Oh Tikahashir

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

Delinquent Filer Voluntary Compliance Program Dfvcp Penalty Calculator And Online Payment With Instructions Examples And Manual Calculations U S Department Of Labor

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

11 Eagle Loan Springfield Oh Tikahashir

Confused About Form 5500 Penalty Amounts Here S Why Leavitt Group